The new litmus to evaluate the

health of companies

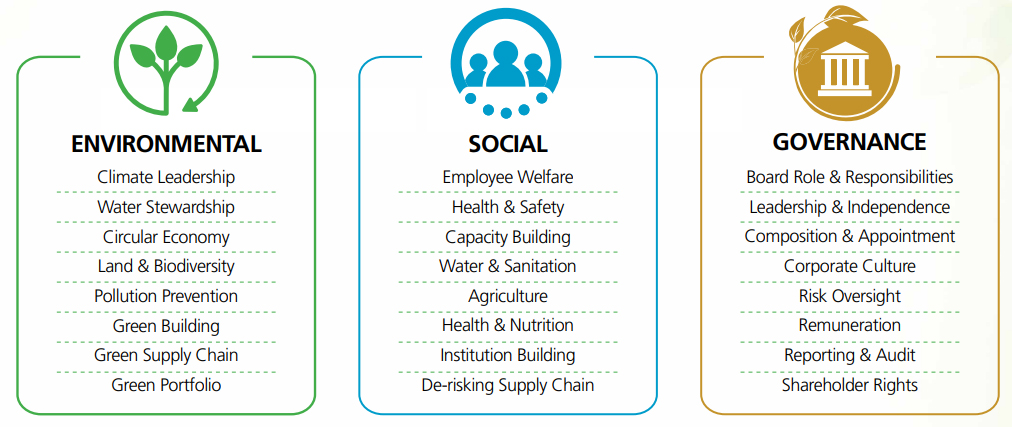

ESG means using Environmental, Social and Governance factors to evaluate companies and countries on how far advanced they are with sustainability. Alternatively, it is also called ‘responsible investing’. The term ‘ESG’ was first coined in 2004 in a landmark study entitled ‘Who Cares Wins’ by the World Bank. According to Forbes, ESG factors cover a wide spectrum of issues that traditionally are not part of financial analysis yet may have financial relevance. This might include how corporations respond to climate change, how good they are with water management, how effective their health and safety policies are in the protection against accidents, how they manage their supply chains, how they treat their workmen and whether they have a corporate culture that builds trust and fosters innovation.

Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities in which it operates, and Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. ESG has taken the world by storm, rising to prominence especially in the post-pandemic era, and is fast becoming the new litmus to evaluate the health of organizations.

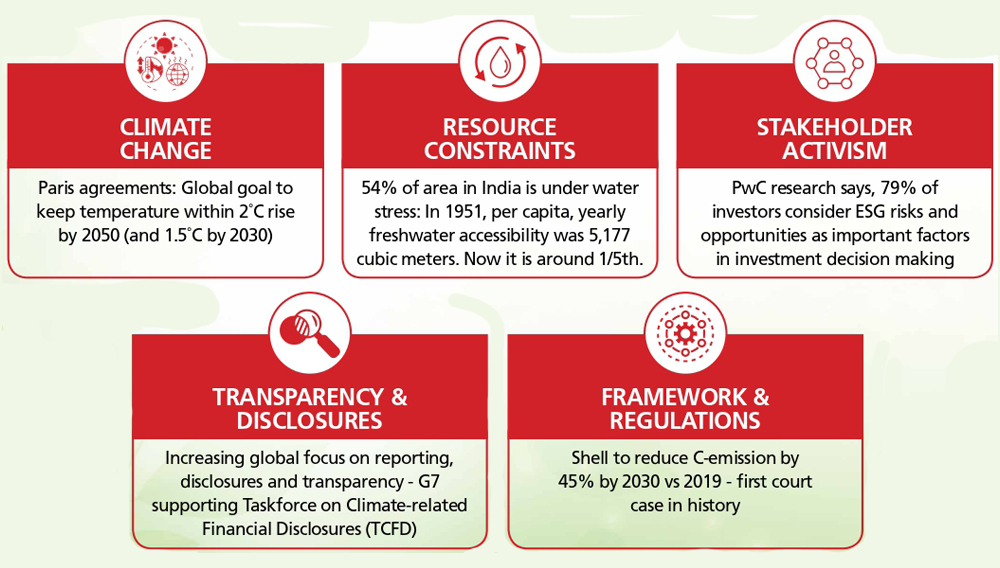

Five major forces are driving ESG and the following illustration has some examples:

ESG was born out of the realization that businesses could no longer function in isolation but are impacted by several issues such as climate change, water security, biodiversity, human rights, community relations, business ethics and the like. It brings with it huge challenges but, at the same time, opens huge vistas of opportunities, and globally, investors are seeking to invest in companies with strong ESG portfolios.

The following table illustrates the subjects covered under ESG:

ESG on a high road to growth

The alarming regularity with which the world has been ravaged by natural disasters in recent times has multiplied global sustainability challenges such as floods, earthquakes, tsunamis, rising sea levels and other risks such as data privacy & security, demographic shifts, regulatory pressures, and the economic disruption due to COVID-19 that are cumulatively increasing the complexity to evaluate investment opportunities. At the same time, advanced technologies, including AI, ML and others, are reducing the reliance on voluntary disclosures by companies, with investors turning instead to more precise data collection, analyses, and validations to deliver dynamic content and financially relevant ESG insights. According to Bloomberg, ESG assets surpassed $35 trillion in 2020 up from $30.6 trillion in 2018 and $22.8 trillion in 2016, reaching a third of current total global assets under management. Assuming 15% growth, at half the pace of the past five years, ESG assets could exceed $50 trillion by 2025, to represent a third of global AUM.

At L&T, our enhanced focus on Environmental, Social and Governance (ESG) parameters has enabled us to engage with stakeholders in a more holistic manner. Our concerted efforts in various areas of sustainability, including mitigating climate change, are yielding results and we will continue to demonstrate leadership in this field.

Mr. A. M. Naik

Group Chairman, Larsen & Toubro

Value creation through ESG alignment

According to McKinsey (2019), ESG creates value in the following dimensions:

- Top-line growth: upward of 70% of consumers surveyed on purchases in multiple industries, including the automotive, building, electronics, and packaging categories, said they would pay an additional 5% for a green product if it met the same performance standards as a nongreen alternative.

- Cost reductions: a major water utility achieved cost savings of almost $180 million per year thanks to lean initiatives aimed at improving preventive maintenance, refining spare-part inventory management, tackling energy consumption and recovery from sludge.

- Regulatory and legal interventions: typically, one-third of corporate profits are at risk from state intervention. The impact of regulation varies between industries. For the automotive, aerospace & defence, and tech sectors, where government subsidies (among other forms of intervention) are prevalent, the value at stake can reach as high as 60%.

- Productivity uplift: Fortune’s ‘100 Best Companies to Work For’ list generated 2.3%-3.8% higher stock returns per year than their peers over a greater than 25-year horizon.

- Investment and asset optimization: a strong ESG proposition can enhance investment returns by allocating capital to more promising and more sustainable opportunities (for example, renewables, waste reduction, and scrubbers).

We have publicly committed to become Carbon Neutral by 2040 and Water Neutral

by 2035, which is well ahead of the Paris Agreement (2015) target date of 2050.

L&T ESG mandate is driven by ‘Technology for Sustainable Growth’

We, at L&T, are keenly focussed to strengthen our ESG rating driven by our vision of ‘Technology for Sustainable Growth’ and to become one of the leading ESG companies with stakeholder engagement across dimensions. We have been consistently incorporating ESG into our strategy and need to continue our work to improve resource efficiency and reduce carbon footprint.

Listed below are some of our actions and performances around ESG:

- Through energy efficiency improvements and focus on renewables, we have been able to improve GHG emission reduction by 10% in FY21 compared to the previous year.

- Our wastewater recycling efficiency at 57% is one of the best across industries. We are also focussing on rainwater harvesting, water conservation and efficiency improvement across our ICs.

- One of our big focus areas is Circular Economy, and we are taking steps to use the 6R (reduce, reuse, recycle, repair, refurbish and rethink) approach to manage waste and improve material recycling.

- We have more than 150,000 trees in our campuses and have recently planted more than two million multispecies trees in different parts of India to improve biodiversity and carbon sequestration for the entire group.

- We are consistently improving our green portfolio businesses, which include solar, water, green hydrogen, etc. Today this comprises ~30% of total revenue.

- A ‘Green Campus Committee’, constituted by SNS, focusses on ambitious targets and makes granular plans in the areas of water, energy, climate change, waste, biodiversity, etc.

- Our renewable energy consumption stands at 10% of total electrical energy consumption, and we would like to take it to 50% by FY26.

- We have publicly committed to become Carbon Neutral by 2040 and Water Neutral by 2035, which is well ahead of the Paris Agreement (2015) target date of 2050.

We are taking milestone decisions to reduce our GHG footprint in line with national and international protocols and improving resource efficiency in our operations. We have sharpened our focus on improving performance across all ESG parameters.

Mr. S. N. Subrahmanyan

CEO & MD, Larsen & Toubro

- We have well-entrenched CSR programmes that focus on areas that align with the global matrices of development — water and sanitation, health, education, and skill-building.

- Our CSR activities have touched and transformed the lives of more than 1.2 million people. We spent a little above Rs. 150 crores in 2020–21 towards CSR activities, which is more than the mandated 2% as per the CSR Rule 2014.

- We ensured that over 165,000 workmen and their families at our project sites continued to receive essential supplies. Their habitations were regularly sanitised and COVID-19 protocols were followed.

- Stringent safety measures were adopted company-wide, across all our projects, plants and offices, that have resulted in fatalities reducing by 40% within a year.

- At L&T, our core values revolve around the principles and ideals based on equity, transparency, accountability, responsibility, compliance, ethics, and trust. Many governance practices that we follow today were voluntarily adopted before they were mandated by law. Our business is run by professionals with rich expertise in their respective areas of operations and they are required to continually demonstrate high governance standards.

- We operate through a 4‑tier management structure, which enables an orderly functioning of the business with two-way feedback and communication methods established between different levels: the Board of Directors, ECom, IC Board, and SBG/SBU.

We need to continuously evolve and engage ourselves on ESG. It is here and now, and we can’t afford to neglect it. We, at L&T, have geared up our activities in this area. Some of the areas where we are working on currently are:

- Developing a new ESG Framework

- Revisiting our Materiality Map

- ESG Roadmap — up to FY26 and beyond

- ESG Communication plan

- ESG Commitments in other areas — Zero Waste to Landfill, Biodiversity Protection, etc. — which are under review and discussion

- Revised and updated disclosures and reporting

Goodbye, theory. Hello action!

We, at Helmet, thank Dr. Pradeep Panigrahi, Head — Corporate Sustainability, Larsen & Toubro, for his valuable inputs in putting together this article.